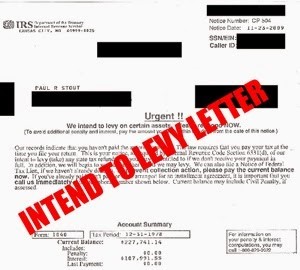

In addition to the requirements of proper notice and demand, two different notices of intent to levy are required. First, §6331(d) requires that the IRS notify the taxpayer in writing of the IRS’s intention to levy on the taxpayer’s salary, wages, or other property, at least 30 days before the date of the levy. In the typical collection case, this is the third notice issued – the CP 504 notice- which serves as the notice of intention to levy required under §6331(d). The second notice of intent to levy is needed to meet the requirements of §6330 by providing notice and an opportunity for a collection due process (CDP) hearing. This notice of intent to levy is typically issued after the CP504 notice and is made by Letter 1058 or Letter LT11. Both notices are supposed to be sent via registered or certified mail to the taxpayer’s last known address.

Thus, although the dreaded CP504 Notice contains language that the IRS may levy your income and bank accounts, as well as seize your property or rights to property if you fail to comply, the IRS may NOT levy, as threatened. Nonetheless the CP504 Notice does have some important consequences which should be considered. First, this notice does enable the IRS to levy upon certain property prior to offering the taxpayer a CDP hearing. This property is set forth at IRC section 6330(f) and includes the taxpayer’s state tax refund. Second, the CP504 Notice causes the “failure to pay” penalty under IRC section 6651(d) to increase from .05% to 1%.

So, what does it mean if the CP504 Notice is “defective” since it clearly serves a legal purpose? Well, it would most certainly invalidate the notice and prevent it from fulfilling its section 6331(d) purpose thus rendering the levy of any section 6330(f) property (including state refunds) invalid.